What is the Super Event Theme?

The Super Event is a scenario manifesting in the OTC markets where, thanks to a large confluence of factors all aligning, there are a historically unprecedented number of longer term asymmetrical trading opportunities. I’m talking about quite a few (relatively) very high probability chart setups with life changing upside potential, which over the years will present themselves but never in the numbers we’re currently seeing.

What is the theme specifically?

Without getting into the why/how this is happening, the theme is more or less this:

- Long term OTC dud/defunct company/empty shell gets cleaned up (if needed) in recent years and becomes a suitable target for either a reverse merger or some form of similar corporate reorganization, ie acquisitions, joint ventures etc.

- The long term chart (10+ years ideally) shows a long base where the float is essentially locked up by a relatively small number of participants while the stock stays range bound and under the radar of the retail market.

- The locked float leads to an initial epic breakout, with this theme largely seeing it’s first manic breakout stage in 2020/21.

- After the manic 2020/21 action the stock essentially dies off and loses a large portion of it’s gains while it tries to find it’s floor. During this time the retail market entirely moves on and assumes that the shell is dead and there are no mergers on the table, and maybe there never were, or at best the merger was lackluster and anticlimactic.

- After the dust settles and the retail crowd moves on, the shares are once again back into the strong hands of a (relatively) few participants, and thus primed to help the price squeeze higher with the proper catalyst.

- Next comes the catalyst where the company reveals they do in fact have plans to move forward, merge or fund new acquisitions with these shell vehicles, and the rally back up is on again.

- The final element to this theme is not just a revisiting of the prior epic breakout highs (often from 2021 in these current S.E.T. plays) but a subsequent break through them to new long term highs, squeezing the stock to absurdly high levels when comparing them to the long term floor price levels.

What makes this theme so special and historically unprecedented?

Massive rallies in the OTC are not uncommon, but what is highly atypical is for a massive breakout to make, hold and confirm a new long term high versus it’s last major breakout move (often years apart from one another). Pull up a 10 or 15 year chart on just about any historical runner and you’ll see that it may be an impressive rally in and of itself, but vs the 15 years of prior trading it’s likely just another lower high and lower low in a perpetual flush out (thanks to reverse splits and further dilution creating a limitless floor).

What makes this theme potentially so important is that I’m hypothesizing that we’re going to see more and more of these long term shells turned merger/acquisition plays make significant higher highs vs their last major tops (2021), which in and of themselves were already meaningful long term highs when they were made. Almost everyone assumes the 2021 madness in the OTC, specifically with these shells/mergers, was a one off event and now it’s back to the perpetual flush out to lower lows and lower highs. My prediction is that we’re going to see more and more of these shells do exactly what I’m describing, ie put in unprecedented (in the OTC) long term higher highs and higher lows, and at some point there will an ‘Ah ha!’ moment in the retail market and capital will flood back into these shells like it was circa 2020 and 2021. The main difference now is that the floats are even more locked up now than they were for that first stage, thanks largely to the past 2 years of selling off in the OTC, as well as the confirmation of long term secular bull markets in these shell/merger charts. Again, that is something you just rarely ever get to see in the OTC. Either the company and it’s share price/chart spirals lower perpetually or else they find long term success and those are the ones that don’t stay on the OTC, they uplist to better exchanges.

What makes you believe this will play out as you’re describing?

I first noticed back in 2020 that there were a number of long term shells/dead charts that seemed to be getting accumulated and having their floats locked down. My hypothesis was confirmed as the OTC bull market came to life in 2021 and almost every empty shell/old ticker seemed to have an epic rally around the same time. The SEC and OTC Markets began ‘cleaning up’ the OTC and that all played a part in the hype and rush into these shells that were being teased and touted as potential mergers. I was dead on with my price & volume based assessment that the floats were being locked up which allowed them to squeeze in the coming months or years, and now my assessment is that many of those same floats are not just still locked up, but more locked up than they were which led to the 2021 mania. A locked float happens when smart money (generic term) loads up or holds when the rest of the market moves on, and that becomes the fertile soil for the next bull market. IMO the soil is even more fertile than it was in 2020/21 and when there’s easy money to made like this, the market has a way of delivering the proper catalysts.

Can you give me any examples of this theme already beginning to play out? Specifically any stocks that meet all the requirements and are now testing or even breaking above their last major milestone peak (likely from 2021)?

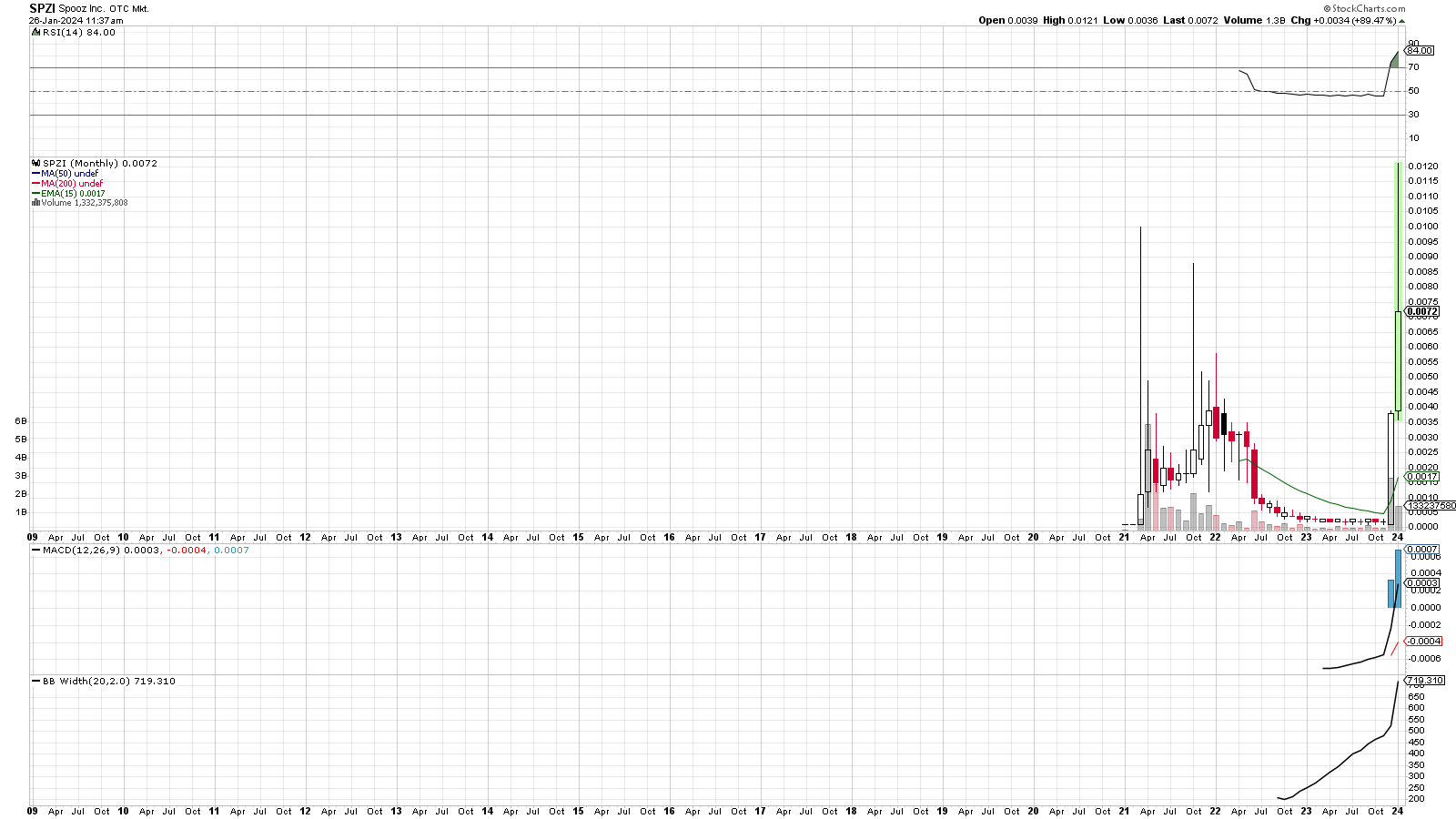

$SPZI is a textbook example of this theme and by the looks of it, I believe it will be one of the key leaders which will pave the way and show the retail market what sort of potential these shells can and do have. Don’t get me wrong, not all of these shells will play out as well as the best examples will, but the best examples will drive the FOMO which will help to elevate all of the old shells/mergers. Here’s $SPZI and it’s long term chart:

Remind me again of the key elements to a S.E.T. play and then point them out for me here with $SPZI and it’s chart.

First key elements are the dead stock/shell phase where the stock barely trades sideways in a long sideways range, sometimes with out much volume or maybe none at all as in the $SPZI case. As you can see on the chart above up until 2021 the chart was blank for over a decade. That’s a drastic example, many of these won’t be so cut and dry, but the idea is the same whether it trades sparsely or not at all. For all intents and purposes the shell was dead to the financial world and the stock more or less goes sideways, ie flatlines.

The next key element is the initial merger/shell clean up hype, again often (but not always centered) around 2021. That phase should be a rally to a new long term high level, which on the $SPZI chart it clearly was.

The next element is the subsequent flush out post 2021 where retail moves on and the stock’s price drifts much lower and tries to find a new floor, ideally at or above the floor prior to the 2021 madness.

After a long dead phase, though not necessarily as dead as it was pre 2021, the stock finds a reason/catalyst to move up and rekindle the prior story and it’s hype. Thus begins the walk back up to the 2021 peak zone. The key for this theme is that we’re going to see something OTC’s rarely do. Follow up one epic rally with another epic rally years later, where rally 2 goes well higher than rally 1 did. As you can see $SPZI has done just that. It managed to get to higher levels, and now the market needs to ‘normalize’ this new long term uptrend and trading levels, and in the process confirm the secular bull market. $SPZI could easily spend months basing in the mid to upper .00Xs (or better), and that would be healthy for the long term health of the stock, and once again it was/is highly unusual to see this happen in the OTC.

With all of that in mind, $SPZI seems to be a poster child for this S.E.T and if it can further base at these levels, the second stage/continuation of the secular bull market is likely to take it to even higher levels than it’s seen so far.

Are there any other examples to look at for reference?

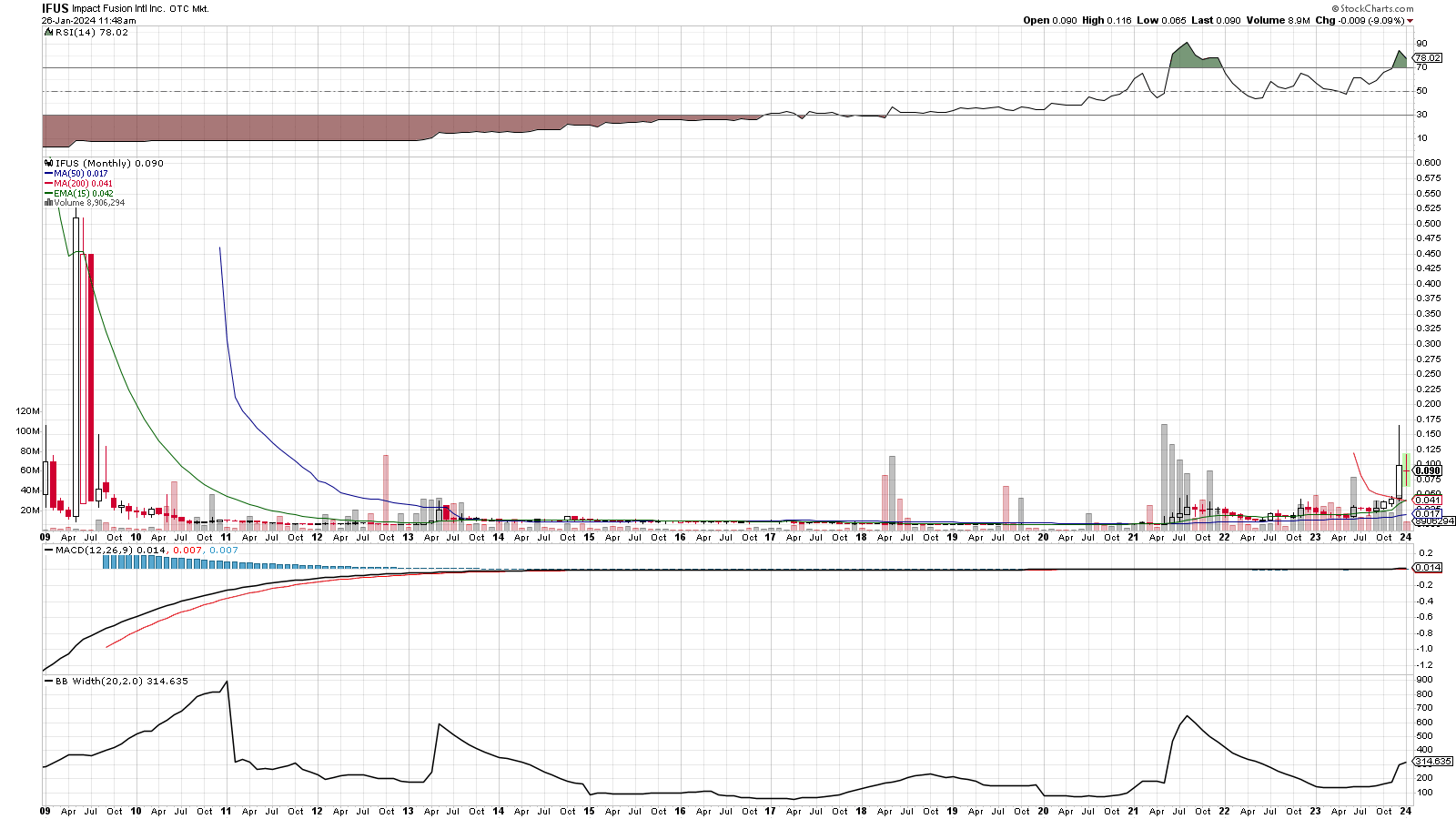

$IFUS is an amazing example and it seems to have had a head start as it’s merger was actually from 2019, not 2021 like many of these S.E.T. plays.

IFUS .0013 X .0015 **New Reverse Merger Stock To Watch** Huge upside here on this low share structure stock. Be sure to radar now. #REVERSEMERGER $IFUS https://t.co/K7zZHadiyK

— PennyStockGeeks (@PennyStockGeeks) October 15, 2019

5 years later it’s still squeezing to new highs and looks poised to pop off bigger and bigger candles. Since the merger for this one actually began in 2019, the 2021 mania in the OTC allowed this stock to confirm a new long term uptrend and it was able to hold it’s gains better than many of the rest of the shell/merger plays from 2021.

$IFUS and $SPZI both had the long sideways bases prior to waking up and breaking out to new long term highs, but $IFUS actually had volume and traded throughout it’s base while $SPZI had it’s flatline phase where it literally wasn’t trading at all. The point is it’s more important to see a long sideways period which extends upwards of a decade or more, whether there’s volume throughout it or not, and then have the stock ‘wake up’ and crack through to a new long term high water mark.

Another interesting note on $IFUS’s situation is that it’s merger began in 2019 and 5 years later the story is really unfolding and the breakout has matured into an absolute monster. Keep that time frame in mind because it’s a successful merger story and seemingly can go even higher still, but it took 5 years and counting to get here. If many of the merger stories in the S.E.T. examples began in 2020/21, then people walking away at this stage are likely going to miss the late stage madness and fun. A reverse merger may be a better route for many businesses to go public rather than a typical IPO, but it’s certainly not a quick or easy process. Even the most successful ones seem to often take 3 – 5 years at least to fully develop.

Can you summarize the main points again?

In 2020/21 a massive movement began and countless old OTC shells were cleaned up and packaged for potential reverse mergers. In the process many made key long term new higher highs, indicating a test of a secular bull market in these types of plays. The hype led to amazing rallies across the OTC but then everything went cold and dry and sold off over the next 2+ years. My main point of emphasis is that I spotted many locked floats in 2020 which lead to the madness of 2020/21, and now after the past 2 years of correcting those very same shells and their floats look to be held even tighter than they were in 2020.

My strong belief is that there is still ample demand for these shells for private businesses, especially foreign businesses who want access to U.S. capital markets, and the demand for the shells will pick back up and usher in a round 2 of madness. Not only will round 2 be of similar nature to what we saw in 2021, but it will expand upon it and take the momentum and prices to new highs. When the market believes a long term peak is set in stone, and then down the road the market forces the prices to break that peak, it’s an admission that the market was very wrong and has to adjust. That’s precisely why a play like $SPZI is so important as it crushes through it’s 2021 peak, and in the process crushes the idea that 2021 was just a one off event.

How do you plan to take advantage of this S.E.T.?

This is the million dollar question. $DFCO, $OCLG and $MIKP are all S.E.T. plays and probably three of the best chart examples that I’m looking for. My plan has been and continues to be buy/accumulate/hold my positions into these major 3 while they’re quiet, cheap and under the radar. Not only do I think they will revisit and retest their 2021 highs, but I think they will ultimately break through them and squeeze to new long term highs. With that being said, this is a general theme I think we’ll see in many tickers.

Short term traders will be more inclined to wait as these S.E.T. plays rally and begin to approach and test their last key long term highs (probably from 2021), but my more patient and aggressive method is to pick my favorites and buy the floor on their current long term corrections. And then wait. There are pros and cons either way. If you wait for the mania to pick up and the tickers to revisit their 2021 peaks first, you will tie up less money than my preferred method, but my strategy has way more upside in the grand scheme of things.

There’s no telling how long these will take, even if they prove to be very successful merger/growth stories. The main point of emphasis is that the floats were locked up a long time ago on a grand scale, and the inevitable fall out is this massive squeezes to long term highs. 2021 saw more tickers than I can recount breakout to long term highs, which was madness in itself. If we see many of those same 2021 runners break to new long term highs, ala $SPZI, there’s no telling how large this bubble will get.

While those 3 tickers mentioned above are my favorite S.E.T. plays currently on my radar, they’re far from the only targets and I know many more will appear and get added to my ever growing watchlists. I think the best thing we can all do is increase our awareness of this theme and discuss this idea as the story unfolds. I don’t want to just be limited to these few plays, if I’m right about this then there will be a tidal wave of shells taking off this year. I don’t believe that all of these mergers will be successful stories, but there will be more than enough success stories which will help to properly fuel the immense FOMO that I envision playing out.

The main elements for a life changing bull market/bubble are here in spades:

- Incredibly tight supply

- Retail market completely oblivious and on the wrong side of the trade

- Undervalued upside potential

- Overpriced in risk

- Compelling catalyst/story in the making which is largely entirely ignored and unseen by the masses

- Immense liquidity potential

I’m getting tired of waiting, your timing really sucks. Can you work on that?

No I can’t. All I can do is spot when these elements are aligning for us, and I can’t stress this enough: In almost 18 years of trading the OTC I’ve never seen conditions like this, on this scale, to this extent and spread out over so many tickers. This is a special event, literally unlike anything we’ve seen or likely will see in our lifetimes. I know the waiting sucks but when you’re talking about trends going into a decade+, then you’re talking very long time frames. I waited 2.5 years for $DFCO finally wake up (after first discovering it in spring of 2018) and confirm my overwhelmingly strong bias. Waiting all that time sucked but when the market caught up to my outlook, it was life changing returns. Fast forward to today and now we’re 2+ years deep into another long term waiting pattern and correction for many of these S.E.T. plays, so in theory there’s a good chance the timing issue is going to be in the rear-view mirror.

I’m writing this mainly for family and friends to hopefully hear me out. If you’re holding any of the big three, I say just keep holding and stay patient. My job is more or less trying to figure out which plays have the best risk/reward as well as the highest probabilities of success. Usually the plays with the best risk/reward have the lowest probabilities of success, and the plays with the highest probability of success have the least impressive risk/reward. These plays and this general theme I’m watching is so special because they have the best of both of those worlds. The main cost for having the best of both worlds is taken out of the time factor, so if you want to give the S.E.T. plays a proper shot, you need to be willing to accept the time costs.

I’m out of questions for now, anything else you want to say on the matter?

I’m writing this to hopefully increase awareness of what I believe is playing out on a more macro picture, specifically in the OTC right now with all of these shells, and how that macro picture is shaping up for this new year. I hope to encourage more discussion on these S.E.T. style plays, and as they increase in momentum and numbers, I want us to be very well aware of that shift as it happens and following it closely. When the number of tickers which test and possibly break their 2021 highs starts to really spike, I want this chat to be all over it. When we catch and begin to take profits on our first big S.E.T. winner, I want to have a nice list of follow up plays that will quite likely follow suit. When we discuss a play and it gets labeled as a strong S.E.T. candidate, I want everyone in the chat to understand exactly what that means and it’s implications. When fortunes are made on the second wave of these shells confirm new secular bull markets, I want the chat to make life changing returns.

I first postulated in late 2020 that something special was happening (had no clue just how special) with more and more dead shell charts getting locked up, I was proven more right than I ever could have imagined. Now after 2+ years of correcting and consolidating, my belief is that this is an even better situation than 2020. What was happening in 2020 has now evolved into where we are now. When you lock up a float on this scale, the degree of upside and squeeze potential is going to be hard to fathom. Especially during such a long lull and correction.

Either I got wildly lucky in the second half of 2020 when I heavily loaded up on shells based purely on what I thought was massive float locking, or I was completely tuned in and knew exactly what I was seeing. I’m more convinced than ever that I was spot on with my assessment, and if that’s the case then watch out for round 2 because it has the potential to change everyone’s lives. If you have any questions or want to further discuss this stuff, post questions and comments in the chat and let’s be ready for what’s coming next.