I wrote an article in July 2019 detailing why I believed $DFCO was a strong buy back then, when the pps was around .04 and the market cap was under $2 million. Fast forward a few years later and the pps is at .345 (after topping out around .90) and the market cap is just under $25 million (as of 7/04/22). At the time of writing that article the company was only recently emerging from a long dead period and the stock was still essentially an empty shell, though it was a shell which was coming to life. That being said, my argument for going long back then was entirely based on the chart and had virtually nothing to do with any of the fundamentals of the company. If I had to quickly summarize my investment thesis back then, it was:

- The price action was impressively strong on a long term time frame, trading and consolidating at long term high price levels, holding well above it’s prior trading with no significant selling.

- The market cap was at the same time very cheap by almost any metric, even if priced only as a clean but empty stock shell.

- This combination of strong price action but still very low market cap made it a very unique opportunity in that it had price and momentum confirmation on a very long term time frame, but it was also priced with such a low valuation that it had incredible upside and nothing but blue skies ahead of it.

To put it another way, it was a sneakingly strong trading stock on a time frame that was very noteworthy but it was at the same time dirt cheap. I didn’t know anything about the company, I just knew that was a combination you rarely see, and one I had never seen to that degree. The price momentum and strength were indicating good things were happening in the underlying supply vs demand dynamic, which tends to be a positive indicator for future price action, and the very low market cap implied expectations were so low that it wouldn’t take much to get the sentiment to turn around.

Even after falling from the high around .90 and now sitting well below that at .345, it’s still obviously been an amazing buy/hold (or flip) since that article came out. I believe I was fully justified in my belief and my thesis was spot on. The unique elements it had going made it a slam dunk in my eyes and I had little doubt it was going to pan out quite well, but in many ways it’s now even more of a steal – this time for different reasons. While the pps and market cap are both up impressively over the past few years, in reality the amount of new information, growth and positive updates for the company go well beyond what the market has priced in. While my first article was entirely focused on the technical argument for being long $DFCO, now in addition to the technical side are the amazing fundamental factors working for the stock. I doubt I’ll be able to do the company justice, but here are some of the most noteworthy positive changes since my first article came out:

- Made some major acquisitions adding immense value to the company, all while avoiding any toxic dilution. The most notable acquisition being Likido Green Energy (more on them later), which was done for just over 6 million shares of restricted common shares. The seller of Likido gave up 100% ownership of the company for a relatively modest amount of common $DFCO shares, which shows incredible faith in the commons and means he has significant skin in the game. This was a huge boost of confidence for me at the time, based on the details of the transaction, but knowing what I know now this acquisition blows my mind. Selling Likido for 6+ million shares of $DFCO showed major confidence in those shares.

- Regained OTC current status for the first time in years, caught up on SEC filings then uplisted to the OTCQB, with a stated target of uplisting to the Nasdaq next.

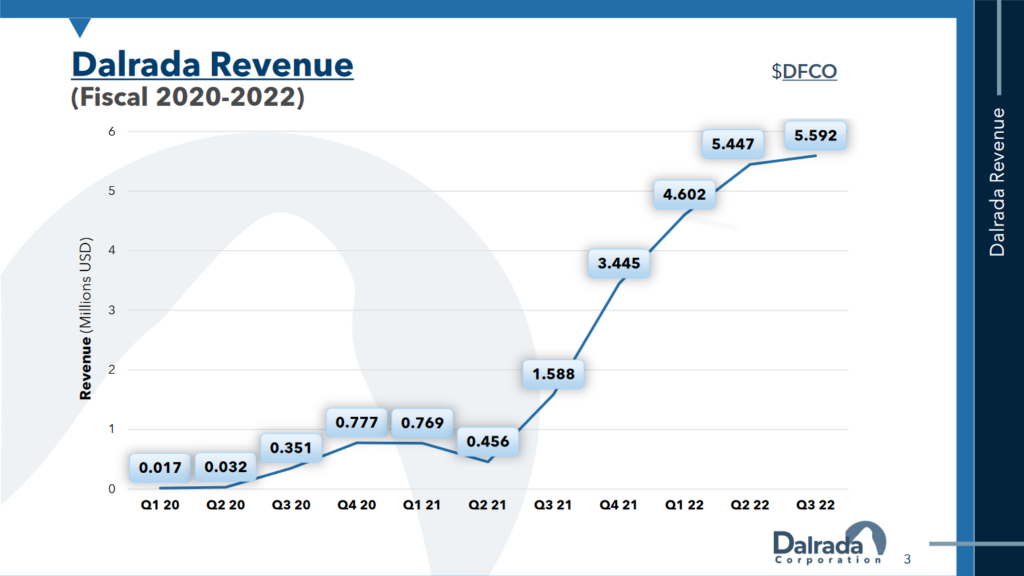

- Have steadily grown the revenue of the company and are now breaking quarterly and yearly records with every financial report, with that trend only heating up.

- Have added more impressive resumes to the board of director than I’ve ever seen compiled on an OTC stock. Bijan Kian, Elizabeth A. Winzeler, Phil Marriott being the big names that really stand out to me. When your board members have their own Wiki page, you’re probably outgrowing your OTC status. And getting a Marriott on the board? I wonder what would happen if Dalrada got a contract with the hotel chain? Hmmm.

But the most exciting update comes from the company’s flagship subsidiary, Likido. Every year the US General Services Administration, in conjunction with the US Dept of Energy, selects a small number of green technologies to help them go commercial and gain market acceptance via a program called Green Proving Ground. Likido’s heat pump was one of six which were accepted and the implications for what this means for the company and it’s stock I don’t think have even begun to sink in to the market’s consciousness. From the GSA.gov website:

WASHINGTON, DC — The U.S. General Services Administration’s (GSA) Green Proving Ground (GPG) program, in collaboration with the U.S. Department of Energy (DOE), has selected six innovative building technologies for evaluation in GSA’s inventory, including the program’s first selections of electric vehicle (EV) charging technology. The GPG program leverages GSA’s extensive real estate portfolio to evaluate innovative building technologies in real-world settings. Evaluation results enable GSA to make sound investment decisions in next-generation building technologies. An additional three technologies will be tested through DOE’s commercial building partners.

The American-made technologies were chosen in response to GSA’s most recent Request for Information seeking technologies for net-zero carbon buildings. The evaluations are intended to validate the technical and operational characteristics of the technologies and their potential for future deployment.

“By using GSA-controlled facilities as a proving ground for innovative clean energy technologies, we can help spur new industries in areas such as energy-saving windows, smart pumps, microgrids, and more,” said GSA Administrator Robin Carnahan. “This demonstrates how our facilities can serve as a catalyst for American innovation that can create good-paying, clean energy jobs, save money for taxpayers and leave our kids a healthier planet.”

C02-Based Heat Pump, Dalrada (Escondido, CA) – Decarbonizing heating is key to achieving Net-Zero. This combustion-free heat pump promises to increase heating and cooling efficiency by capturing and reusing thermal energy while reducing global warming potential. Using carbon dioxide as the refrigerant, this heat pump can deliver cooling down to -22°F and heating up to 250°F.

And here are other links referencing this huge accomplishment for the company:

GSA to Demonstrate and Field-Validate Next-Generation Building Technologies

Green Proving Ground, GSA Tabs Dalrada Heat Pump

GSA Selects 6 Clean Energy Tech Products for Evaluation in Federal Buildings

See the cutting-edge tech turning government buildings into lean, green machines

Here’s an especially intriguing quote from this last article, heavy emphasis on the comment by the director of emerging building technologies for the GSA’s Public Buildings Service:

Heat pumps are another emerging technology being embraced by the GPG program. Because they capture and reuse thermal energy, heat pumps are far more efficient at heating and cooling buildings than traditional systems, and are increasingly being used in residential buildings. The heat pump selected for the program, developed by California-based Dalrada Corp., uses CO2 as its refrigerant—a technology that was previously available only at an industrial scale. It can generate temperatures between minus 22 degrees and 250 degrees Fahrenheit, using much less energy than conventional systems.

“If it does deliver on all of its promises, this is a game changer,” Powell says.

In and of itself I believe this GSA announcement is an absolute game changer for the company and it’s stock, but it’s the meta picture for this news that makes it almost too good to be true. When you understand that our flagship is the Likido heat pump technology and what it brings to the table, then factor that on top of the overall climate and news coming out of the White House these days, you can begin to understand just how much potential lies dormant here. Do a few minutes of DD on heat pumps and our current administration, ie google “Biden Heat Pumps“, and then it sets in how truly undervalued this opportunity is. Here are a few articles that came to the top of the news results:

Biden to Manufacturers: Build More Heat Pumps

Biden Order Will Boost Heat Pumps and Building Insulation

Why Joe Biden is invoking a war power to build heat pumps and solar panels

President Biden Invokes Defense Production Act to Accelerate Domestic Manufacturing of Clean Energy

Why Biden Just Declared Heat Pumps and Solar Panels Essential to National Defense

Heat pumps are ready for prime time and ripe for innovation

Heinrich Welcomes Biden Executive Action On Heat Pumps, Electrification

I can’t overstate how big this opportunity is, and I think it was the worst time possible for such a paradigm shifting turn of events to occur for $DFCO – at least in terms of it’s immediate price reaction. The markets have recently been more unfavorable than they’ve been since March 2020 and this news and the opportunity it’s presented have gone basically unnoticed. While that may be frustrating to longs like myself, it’s also an amazing opportunity to buy shares at a heavily discounted price vs. what’s already known about the company, it’s fundamentals and it’s amazing growth story.

I think based on everything we’ve seen since my first article, we’re clearly looking at a company destined for a much higher market cap than it’s current $25 million and a stock that should be and will be trading on the Nasdaq. It’s a rare opportunity, just like back in July 2019, but this time it’s because the fundamentals simply aren’t being accurately priced into the current pps – thanks largely due to the overall market conditions being horrific of late.

As for my personal disclaimer, just like I stated in the first article I am long and very bullish on $DFCO. I believe in holding a core position on strong long term holds like this, selling smaller blocks into strength as it moves up, then possibly buying back some shares on any deeper dips. This has been my M.O. since I first bought in back in early 2018 and I’ve held a large core position ever since, and plan to continue to hold until much higher prices. I think this stock can hit something wild, whether it’s $5, $50 or $500 I don’t know, but I think it has the potential to not only trade much higher than it’s current levels, but that it can do so with significantly more liquidity than it currently sees as well. That’s my take and I believe the stars have aligned better than I could have ever imagined here, but as always you have to be the master of your domain. Invest only what you can afford to lose, take some profits when things get super wild to the upside and don’t get too greedy with your entire position (but being very greedy with some of it makes a lot of sense here, imo).

One final caveat, my strength is in reading charts and doing my DD on a company and it’s fundamentals is not my strong suit. If you want a better idea of the entire company and it’s impressive growth to date, I suggest checking out this investor presentation PDF as well as listening to this recent presentation by the CEO Brian Bonar. Honestly that last video is well worth the 26 minutes and sums up virtually everything going on with the company, at least everything that’s currently known by the public.

Long story short, while in my first article I talked about how $DFCO was an undervalued empty shell showing very impressive price strength on the charts, but with nothing known about the company itself and it’s direction/potential, now we know infinitely more than we did back then and it’s even more undervalued now then it was back then. With so much progress and amazing potential now known to the market, yet remarkably not being priced in yet due to what are ultimately going to be arbitrary reasons, I believe buying shares at this current price level are even better bets than buying the .04s was back in July 2019. There are no sure things in life (and certainly not in the OTC market) but based on what’s known vs what’s actually been priced in, $DFCO at these current prices are about as good of a combination of high upside and high probability (of success) as it gets. As much as I liked what I saw back in July 2019, I don’t think that was anywhere near as intriguing of an opportunity as what we’re seeing right now.